Investor Relations

- Home

- Investor Relations

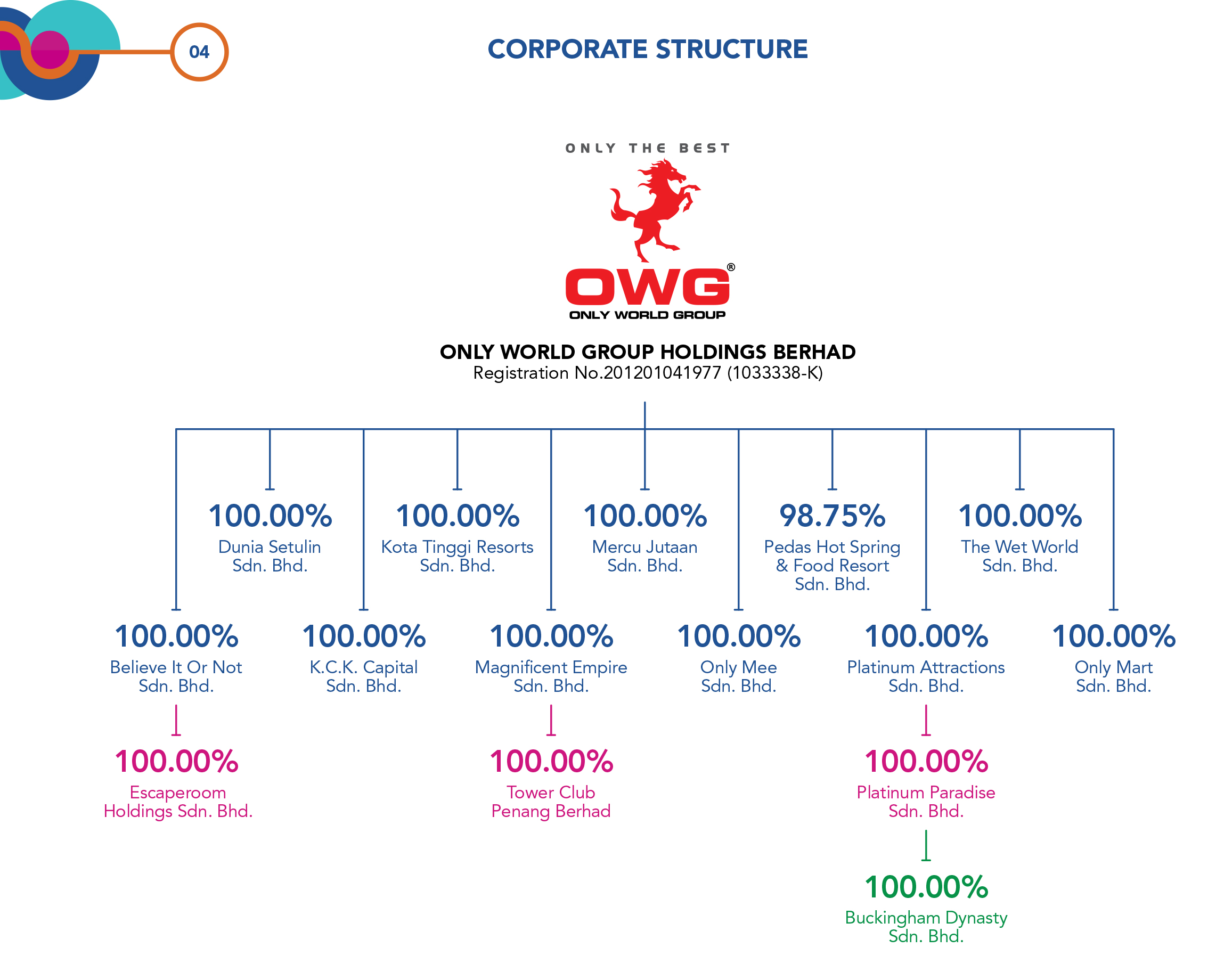

Corporate Information

- Corporate Group Structure

- Director's Profile

- Vision & Mission

- History & Business Summary

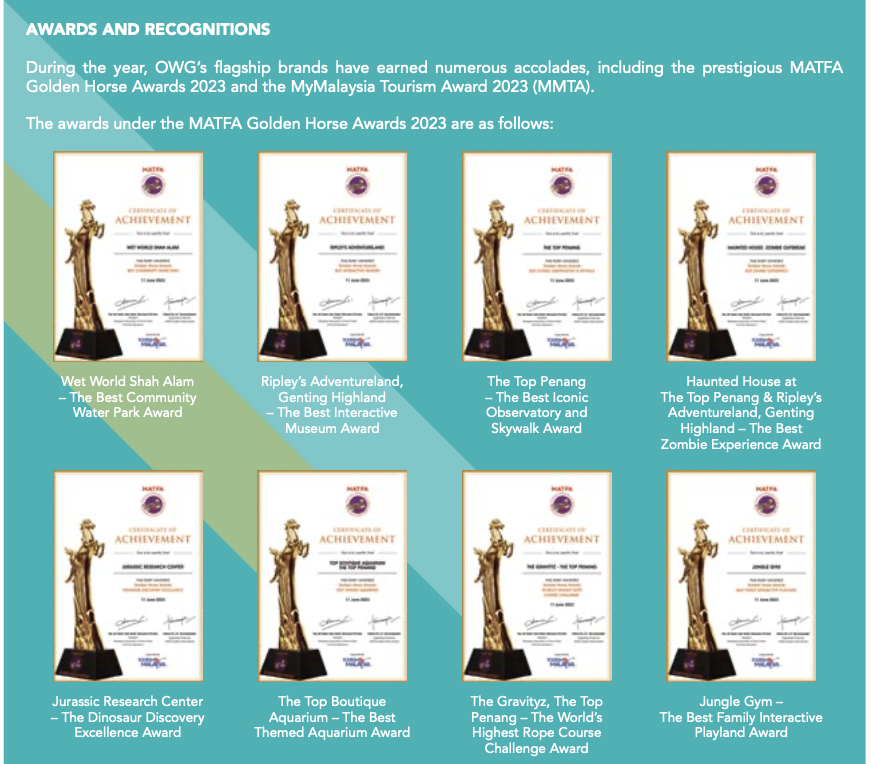

- Awards

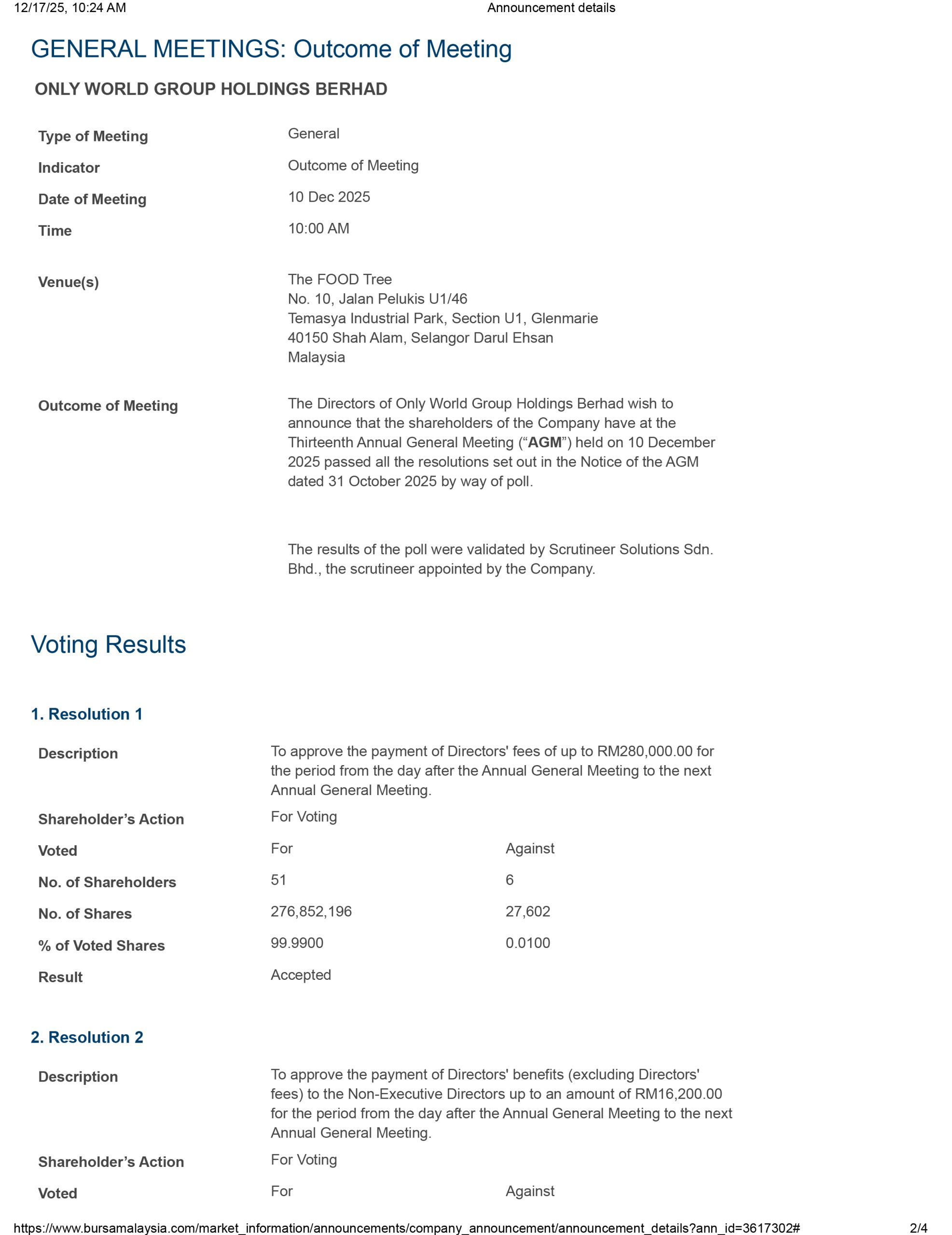

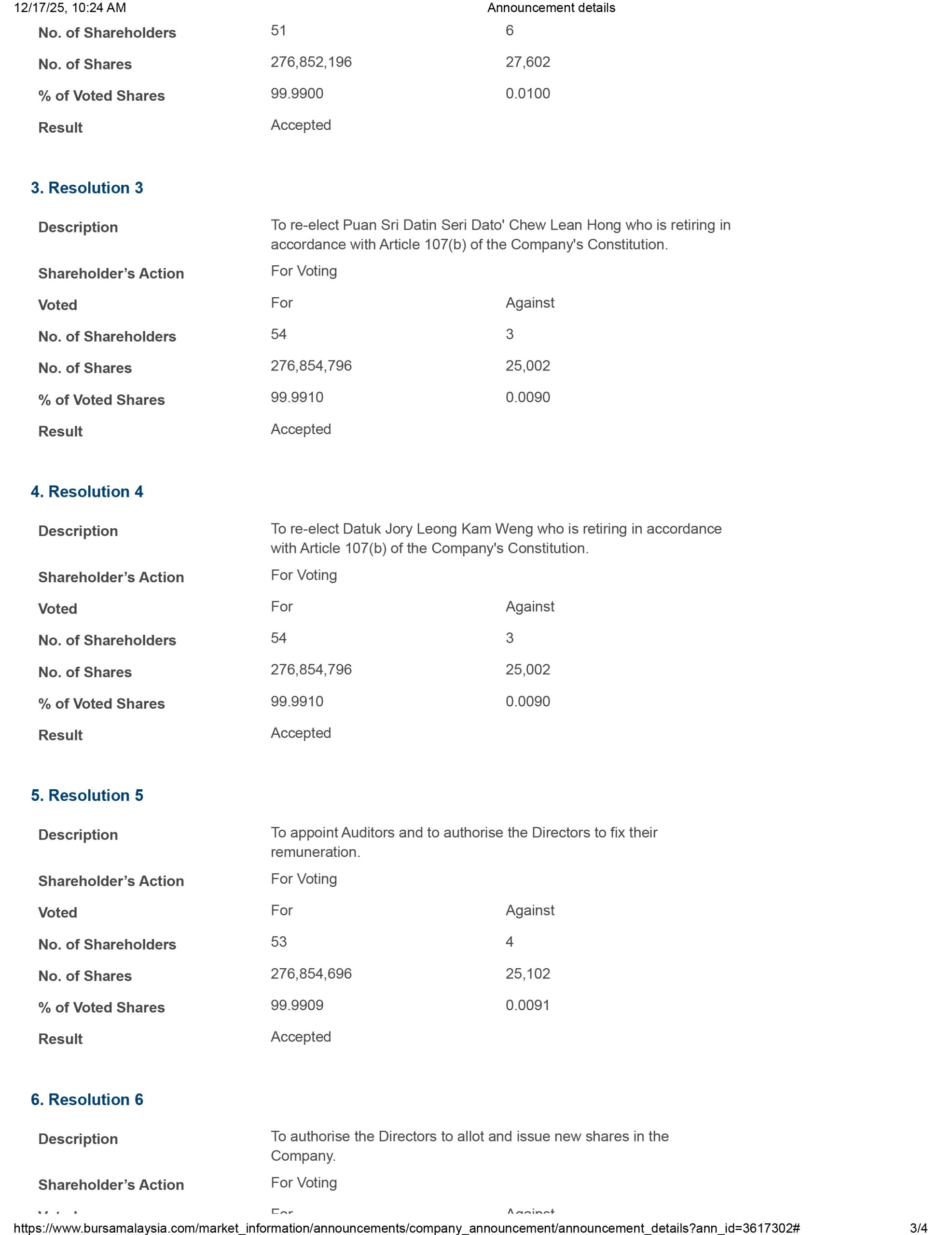

- Annual General Meetings

TanSri Foong Cheng Yuen profile

Tan Sri Foong Cheng Yuen was appointed as the Independent Non-Executive Director of the Company on 5 February 2015 and redesignated as Senior Independent Non-Executive Director on 21 August 2016. He had been redesignated as Senior Independent Non-Executive Chairman on 22 July 2020 and subsequently on 26 August 2020, he had been redesignated as Independent Non-Executive Chairman. He is a member of the Audit Committee, Nominating Committee and Remuneration Committee.

He graduated from the University of London with LL.B. (Honours) in 1969 and was called to the English Bar by the Honourable Society of the Inner Temple in 1970. Subsequently, he was called to the Malaysian Bar as an advocate and solicitor in 1971. He was engaged in private legal practice in both criminal and civil law, majoring in insurance law from 1971 to 1990. While in practice, he acted as legal adviser to numerous guilds and associations in Malaysia. He was a Commissioner of Oath and Public Notary. He was conferred honorary Doctorate of Laws degree by the University of the West of England in 2011. He was also made Bencher of the Honorable Society of the Inner Temple, London in 2009.

He was appointed as Judicial Commissioner in 1990 and elevated to be High Court Bench in 1992. He also served as a High Court Judge at Kuala Lumpur (Criminal Division), Johor Bahru, Shah Alam, Kuala Lumpur (Civil Division), Ipoh, and Kuala Lumpur (Family Division and Civil Division). He was elevated to the Court of Appeal in 2005 and subsequently elevated to the Federal Court (Malaysia Supreme Court) in 2009. As a Federal Court Judge, he was made a Managing Judge of the Civil Division of the High Court at Kuala Lumpur and of the High Court and Subordinate Courts in the State of Penang. He retired from the Malaysian Judiciary on 25 February 2012.

He now practises law as an advocate and solicitor. He is also an arbitrator.

Tan Sri Foong Cheng Yuen is presently the Deputy Chairman of Genting Berhad and Chairman of Ombudsman for Financial Services.

Tan Sri Foong Cheng Yuen is not related to any Director or major shareholder of the Company. He does not have any conflict of interest in any business arrangement involving the Company or its subsidiaries. He has no conviction for any offences within the past 5 years and has no public sanction or penalty by the relevant regulatory bodies during the financial year ended 30 June 2023.

He attended all six (6) Board Meetings held during the financial year.

Tan Sri Dato’ Seri Dato’ Koh Cheng Keong

Tan Sri Dato’ Seri Dato’ Koh Cheng Keong was appointed as the Managing Director and Group Chief Executive Officer of the Company on 8 November 2012.

He completed his secondary school education in 1971 and ventured into various businesses including entertainment, theme park and food and beverage. He is actively involved in various trade associations. He held the position of President of the Malaysian Association of Themepark & Family Attractions (MATFA) from 2003 to 2013 and Honorary Advisor of MATFA in 2013 to 2018. He was re-elected as the President for MATFA in 2019 to 2023. Currently, he is the Honorary Chairman for MATFA.

Tan Sri Dato’ Seri Dato’ Koh Cheng Keong also held the position as Advisor for the Malaysian Entrepreneurs Development Association (PUMM Penang) and is a member of ASEAN Advisory of the International Association of Amusement Parks & Attractions (IAAPA). Tan Sri Dato’ Seri Dato’ Koh Cheng Keong has also been appointed as an Advisor for the Federation of Malaysian Business Associations (FMBA) and Association of Tourism Attractions, Penang (ATAP) in August 2021 and December 2021 respectively.

He was the President of ASEAN Retail Chain Association (ARFF) from March 2013 to March 2018 before appointed as the Chairman of ARFF in March 2018.

He does not hold any directorship in any other public or public listed company.

Tan Sri Dato’ Seri Dato’ Koh Cheng Keong, the spouse of Puan Sri Datin Seri Dato’ Chew Lean Hong and father to Ms Koh Jia Tien, is a director and shareholder of Rich Dad Cafe Sdn. Bhd., a major shareholder of the Company.

He does not have any conflict of interest in any business arrangement involving the Company or its subsidiaries, save as disclosed in the circular to the shareholders dated 31 October 2023. He has no conviction for any offences within the past 5 years and has no public sanction or penalty by the relevant regulatory bodies during the financial year ended 30 June 2023.

He attended all six (6) Board meetings held during the financial year.

Puan Sri Datin Seri Dato’ Chew Lean Hong

Puan Sri Datin Seri Dato’ Chew Lean Hong was appointed as the Executive Director and Group Chief Operating Officer of the Company on 8 November 2012.

She completed her secondary school education in 1973 and embarked on a career in life insurance where she honed her skills to find new leads, to work with prospects to identify needs, create solutions and ensure a smooth sales process. This developed into an intrinsic motivation for a disciplined approach towards personal development and growth. Three years later, she joined World Equipment Sdn. Bhd., a company whose main business is in the design, build and operations of themed and amusement parks. In addition to the day-to-day operations of the Company, she managed various new businesses including entertainment, theme parks and food and beverage. Her focus was on business development, inter-control systems, human resource and development and operations. She learnt to appreciate meticulous preparations and thorough research in delivering the best results in every situation. Having a keen interest in theme parks development and operations, she enrolled for the Amusement Parks and Attractions Institute Program at Cornell University in 1993.

She does not hold any directorship in any other public or public listed company.

Puan Sri Datin Seri Dato’ Chew Lean Hong, the spouse of Tan Sri Dato’ Seri Dato’ Koh Cheng Keong and mother to Ms Koh Jia Tien, is also a director and shareholder of Rich Dad Cafe Sdn. Bhd., a major shareholder of the Company.

She does not have any conflict of interest in any business arrangement involving the Company or its subsidiaries, save as disclosed in the circular to the shareholders dated 31 October 2023. She has no conviction for any offences within the past 5 years and has no public sanction or penalty by the relevant regulatory bodies during the financial year ended 30 June 2023.

She attended all six (6) Board Meetings held during the financial year.

General Dato’ Seri DiRaja Tan Sri (Dr.) Mohd Zahidi Bin Haji Zainuddin (R)

General Dato’ Seri DiRaja Tan Sri (Dr.) Mohd Zahidi Bin Haji Zainuddin (R) was appointed as the Independent Non- Executive Director of the Company on 22 July 2020 and subsequently redesignated as Senior Independent Non- Executive Director on 26 August 2020. He is the Chairman of both Nominating Committee and Remuneration Committee. He is also a member of the Audit Committee.

He had a distinguished career in the Malaysian Armed Forces for nearly 40 years, before retiring from the Force on 30 April 2005. During the period as a professional military officer, he served 6 years 4 months as the Malaysian Chief of Defence Forces from 1 January 1999 and as the Chief of the Malaysian Army for one year from 1 January 1998. In international duties, General Dato’ Seri DiRaja Tan Sri (Dr.) Mohd Zahidi (R) served as a Military Observer under the United Nations International Monitoring Group in Iraq after the Iran-Iraq War Ceasefire in 1988/1989.

General Dato’ Seri DiRaja Tan Sri (Dr.) Mohd Zahidi (R) was made a Member of Dewan Negara Perak by DYMM Paduka Seri Sultan Perak on 25 November 2006 and is a Director/ Trustee for the Board of Trustee of Yayasan Sultan Azlan Shah. On 23 April 2013, General Dato’ Seri DiRaja Tan Sri (Dr.) Mohd Zahidi (R) was appointed as Orang Kaya Bendahara Seri Maharaja Perak Darul Ridzuan by DYMM Paduka Seri Sultan Perak and the Dewan Negara Perak Darul Ridzuan. On 19 April 2014, he was bestowed with the Perak’s highest award for commoners, the ‘Darjah Kebesaran Seri Paduka Sultan Azlan Shah Perak Yang Amat Dimulia’ (S.P.S.A) which carries the title “Dato’ Seri DiRaja”.

General Dato’ Seri DiRaja Tan Sri (Dr.) Mohd Zahidi (R) holds a Masters of Science degree in Defence and Strategic Studies from the Quaid-I-Azam University, Islamabad, Pakistan and had attended the Senior Executive Programme in Harvard University, United States of America, Command and General Staff College Philippines, Joint Services Staff College Australia and National Defence College Pakistan. In June 2015, Asia Metropolitan University (AMU) elected General Dato’ Seri DiRaja Tan Sri (Dr.) Mohd Zahidi (R) as the Chancellor of the University. In October 2016, General Dato’ Seri DiRaja Tan Sri (Dr.) Mohd Zahidi (R) was conferred with an honorary doctorate in Management of Defense and Strategic Studies from National Defence University of Malaysia, also known as Universiti Pertahanan Nasional Malaysia (UPNM).

Presently, General Dato’ Seri DiRaja Tan Sri (Dr.) Mohd Zahidi (R) is the Chairman of Genting Plantations Berhad. He is also a Director of Genting Malaysia Berhad, Cahya Mata Sarawak Berhad, AHAM Asset Management Berhad and several private limited companies in Malaysia.

General Dato’ Seri DiRaja Tan Sri (Dr.) Mohd Zahidi (R) is not related to any Director or major shareholder of the Company. He does not have any conflict of interest in any business arrangement involving the Company or its subsidiaries. He has no conviction for any offences within the past 5 years and has no public sanction or penalty by the relevant regulatory bodies during the financial year ended 30 June 2023.

He attended all six (6) Board meetings held during the financial year.

Datuk Jory Leong Kam Weng

Datuk Jory Leong Kam Weng was appointed as the Independent Non-Executive Director of the Company on 9 February 2022. He is the Chairman of the Audit Committee and member of both Nominating Committee and Remuneration Committee.

He graduated with a Bachelor of Economics Degree and a Bachelor of Laws Degree from Monash University, Australia. He is a Fellow of CPA Australia and a Chartered Accountant of the Malaysian Institute of Accountants. He is also a certified mediator on the panel of the Malaysian Mediation Centre.

He was called to the Malaysian Bar in 1989. In February 1992, he joined TA Enterprise Berhad as the Group Legal Manager until July 1995. He was the Vice President of International Division of TA Enterprise Berhad from November 1993 to October 1995. In between November 1995 to February 1997, he held the position of Executive Director of Credit Leasing Corporation Sdn. Bhd. He also held the post of Executive Director of TA Bank of Philippines, Inc from March 1997 to June 1998. From June 1998 to July 1999, he was the Chief Executive Officer of TA Securities Berhad. Since July 1999, he has been a Partner of Messrs Iza Ng, Yeoh & Kit as a practising Advocate and Solicitor.

Datuk Jory is presently the Independent Non-Executive Chairman of Pan Malaysia Holdings Berhad, an Independent Non-Executive Director of Malayan United Industries Berhad, Pecca Group Berhad, and Xin Hwa Holdings Berhad, companies listed on Bursa Malaysia Securities Berhad. Datuk Jory is also an Independent Non- Executive Chairman of Tokio Marine Life Insurance Berhad and other several public limited companies namely, Asian Outreach (M) Berhad and Pusat Penyayang KSKA. He also sits on the board of several private limited companies.

Datuk Jory Leong Kam Weng is not related to any Director or major shareholder of the Company. He does not have any conflict of interest in any business arrangement involving the Company or its subsidiaries. He has no conviction for any offences within the past 5 years and has no public sanction or penalty by the relevant regulatory bodies during the financial year ended 30 June 2023.

Datuk Jory Leong Kam Weng attended six (6) Board Meetings held during the financial year.

Koh Jia-Tien

Koh Jia-Tien was appointed as the Alternate Director to Tan Sri Dato’ Seri Dato’ Koh Cheng Keong on 30 May 2023.

Jia-Tien graduated with a Bachelor’s degree in Business in International Liberal Studies from Waseda University in 2009. In March, 2012, Jia-Tien joined the Company as the Personal Assistant to the Chief Operating Officer and currently she is our Managing Director of F&B, a position she has held since July 2022.

Jia-Tien is a daughter of Tan Sri Dato’ Seri Dato’ Koh Cheng Keong and Puan Sri Datin Sri Dato’ Chew Lean Hong. She does not have any conflict of interest in any business arrangement involving the Company or its subsidiaries. She has had no convictions for any offences within the past 5 years and has no public sanction or penalty by the relevant regulatory bodies during the financial year ended 30 June 2023. She does not hold any directorship in other public or public listed company.

After her appointment on 30 May 2023, there was no board meeting prior to the end of the financial year of 30 June 2023.

VISION

We embrace the mission of making sound business strategies, leading the way, finding opportunities and striking gold in providing the best of leisure, entertainment and hospitality (F&B).

MISSION

We visualise that people of the world will have an opportunity to experience “Fun, Food and Good Living” as Only World Group works diligently and relentlessly in fulfilling the vision.

What We Do

Inspired by the strong and silent demeanour of the horse, Only World Group has been working behind the scenes, silently, in bringing people together and creating fond memories until present.

As the Group embraces the philosophy of “Fun,Food and Good Living”, it also make strides in operating and managing F&B and leisure related brands, found in popular resorts and shopping malls.

The Group ventures into good living by providing outlets to relax the body and revitalise the mind namely spas and other related activities. As the future beholds, Only World Group will continue to run ahead in affirming our position of being Only the Best in what we do. With our experience, coupled with forward thinking leaders, we will implement the best business strategy and system in exploring new horizons to create more sparks that will excite the world in terms of “Fun, Food and Good Living”.

History

Beginning

In 1973, Only World Group was established with the purpose of creating and designing fun centers for the family and roller skating rinks throughout Malaysia. It then designed and built the country’s first large scale amusement- Taman Subang Ria Park in 1980. As the years progressed, Only World Group has taken significant roles in huge projects such as Resorts World Genting, Universal Studios Singapore, Wet World Waterparks, Sunway Lagoon Resort, Mines Wonderland and Desa WaterPark. The Group involved in designing, building and managing Wet World Shah Alam, Wet World Air Panas Pedas Resort and Wet World Batu Pahat Village Resort. It has also received accolades in the Malaysia Book of Records for the “Longest Water Propelled Coaster” for Wet World WaterPark Shah Alam (2001).

Our Company was incorporated in Malaysia under the Act on 8 November 2012 as a private limited company under the name of Only World Group Holdings Sdn Bhd and was subsequently converted to a public company limited by shares on 6 June 2013.

Establishment

We are an investment holding company and are engaged in the provision of management services whilst our Subsidiaries are principally providers of leisure and hospitality services incorporating the operation of food service outlets, water amusement parks and family attractions and other services.

The history of our Group can be traced back to 1984 with the establishment of a private limited company, namely Family Fun World Sdn Bhd, the owner of the Wet World brand and is principally engaged in the merchandising of the Wet World branded products. In 1997, Family Fun World Sdn Bhd changed its name to Wet World Sdn Bhd and subsequently assumed its present name in 2002.

In 1996, our Group through Mercu Jutaan had commenced our foray into the leisure and hospitality industry by opening our first (1st) water amusement park, namely Wet World Water Park Shah Alam in Selangor Darul Ehsan. Three (3) years later, our Group through Pedas Hot Spring, had launched our second (2nd) water amusement park, namely Wet World Air Panas Pedas Resort in Negeri Sembilan Darul Khusus.

Venture

In 1997, our Promoters acquired Tanjung Keris Sdn Bhd, which is now known as Platinum Attractions and launched our third (3rd) water amusement park, namely Wet World Batu Pahat Village Resort in Johor Darul Takzim in 1999. Subsequently in 2003, Platinum Attractions expanded its business operation into the food service sector and opened Only Curry House, now known as jR CURRY at First World Plaza, Genting Highlands.

In 1999, our Group ventured into resort operations through Kota Tinggi Resorts and opened Kota Tinggi Waterfalls Resort in Johor Darul Takzim. In the same year, our Group ventured into the food service sector when Dunia Setulin commenced its business operations and opened our first (1st) Marrybrown franchise outlet at Theme Park Hotel, Genting Highlands. We opened our second (2nd) Marrybrown franchise outlet in 2005 at First World Plaza, Genting Highlands.

Launch

In 2002, our Group through Platinum Paradise had launched three (3) other food service outlets, namely Yummy Yummy, now known as Jia Food For The Seasons, Mmm Yum Yum Bak Kut Teh, now known as eastcourt and Shanghai 10, which are all located at First World Plaza, Genting Highlands. Platinum Paradise had also opened other food service outlets, namely HOT POT, eastcourt and RICHDAD at First World Plaza, Genting Highlands in 2005, 2007 and 2009, respectively.

In 2003, our Group, through KCK had set-up a centralised kitchen facility, which is located at our corporate office in Shah Alam, Selangor Darul Ehsan to support the Group’s food service operations and to facilitate the Group’s in-house R&D activities. In the same year, Believe It or Not had entered into a franchise agreement with Ripley’s Attractions, Inc. and subsequently opened RIPLEY’S Believe It or Not and HAUNTED ADVENTURE at First World Plaza, Genting Highlands.

Expansion

In 2005, our Group through Only Mee opened Only Mee food service outlets at First World Plaza, Genting Highlands and SACC Mall, Shah Alam in Selangor Darul Ehsan. In the same year, our Group also opened other food service outlets, namely Market Food Street and Only Easy Store at First World Plaza, Genting Highlands.

Subsequently in 2006, our Group expanded our presence to East Malaysia and opened Only Mee food service outlet at Kuching International Airport, Sarawak. In the same year, Magnificent Empire opened London CAFE and three (3) other F&B kiosks at the Outdoor Theme Park, Genting Highlands.

In 2008, Magnificent Empire opened Only Easy Cafe, now known as 1 Meter Teh at First World Plaza, Genting Highlands. Platinum Paradise established a food preparation area located at First World Plaza, Genting Highlands in 2009. One (1) year later in 2010, Platinum Paradise opened a food service outlet, known as The FOOD tree at our Group’s corporate office in Shah Alam, Selangor Darul Ehsan.

Financial Information

Click here to view (OWG-Notice to Warrantholder on Maturity of Warrants (Final)

Address : Unit 32-01, Level 32, Tower A, Vertical Business Suite, Avenue 3, Bangsar South, No. 8, Jalan Kerinchi, 59200 Kuala Lumpur, Malaysia

Tel : 603-2783 9299

Fax : 603-2783 9299

Contact Person : Encik Mohd Kamal Bin Mohd Din

Share Registrar : Tricor Investor & Issuing House Services Sdn. Bhd.

Corporate Governance

1. POLICY AND OBJECTIVE

The objective of the Whistleblower Policy and Procedure (“Policy”) are:-

a. To promote an environment where integrity and ethical behaviour in Only World Group Holdings Berhad (“OWGH”) and its subsidiaries (“Group”)

b. To act as an early warning system in identifying any suspected and/or known illegality, misconduct, wrongdoings, corruption, fraud, waste and/or abuse in the Group and may enable the Group to remedy any wrongdoings before serious damage is caused.

c. To provide a formal and confidential channel to enable employees and/ any reporting individual (“RI”) to report in good faith, serious concerns of any suspected and/or known illegality, misconduct, wrongdoing, corruption, fraud, waste and/or abuse that could adversely impact OWGH and its subsidiaries, shareholders, investors, employees and business partners without fear of being subject to detrimental action.

2. SCOPE OF POLICY

2.1 This Policy applies to :

a. All employees of the Group.

b. Any persons providing services to the Group

c. Member of the public where relevant.

2.2 The Policy covers the following allegations of misconduct, wrongdoing or improper conduct or abuse:

a. act which constitutes a criminal offence under the law, such as fraud, corruption, forgery, cheating, criminal breach of trust, insider dealing, abetting or intending to commit criminal offence.

b. Failure to comply with legal, regulatory obligations or rules that applicable to the Group.

c. Any act that is likely to cause significant financial loss or costs to the Group including any intentional misrepresentation of the Group.

d. Any breach of ethics as described in the Code of Ethics and/or any fraudulent act including such acts include forgery, theft, any form of corruption (including accepting and giving bribes), unauthorised disclosure of OWGH and its subsidiaries’ confidential information and abuse of power for personal gain.

2.2 The Policy covers the following allegations of misconduct, wrongdoing or improper conduct or abuse: (continued)

e. Gross waste of the Group’s resources or intended destruction of Group’s property.

f. Damage to the environment.

g. An act or omission which creates a substantial and specific danger to lives, health or safety risk to the Group, Public as well other Employees.

h. Other unethical conducts.

i. Deliberate concealment of information concerning any of the matters listed above The above list is not exhaustive. This Policy does not apply or replace the Group’s existing range of policies and procedures which deal with standards of behaviour at work. Employees are encouraged to use the provision of these procedures when appropriate.

3. OVERSIGHT AND OWNERSHIP OF POLICY

3.1 The Audit Committee of the Group has overall responsibility for this Policy and shall oversee the implementation of this Policy

3.2 The Audit Committee has delegated day-to-day responsibility for the administration and implementation of the Policy to the Chief Executive Officer (“CEO”) and Chief Operating Officer (“COO”). The use and effectiveness of this Policy shall be regularly monitored and reviewed by the CEO and COO.

3.4 The owner of this document is CEO and COO who shall be responsible for incorporating any amendments and updates into this document, obtaining the approval of the Audit Committee for those amendments and updates and distributing the same to the relevant parties.

4. REPORTING IN GOOD FAITH

4.1 The RI must have reasonable and proper grounds before reporting such misconduct and must undertake such reporting in good faith, for the best interest of the Group and not for personal gain or interest.

4.2 The reporting of misconduct could be deemed as lacking of good faith, when:

a. the RI does not have a factual basis for the report of misconduct; and/or

b. the RI knew or reasonably should have known that the report or any of its contents are false; and/or

c. where the report is superficial senseless and is a form of harassment; and/or

d. there are any other circumstances that indicate that the report has been made with malicious intent, hidden motive or for personal gain.

4.3 Any person that has not acted in good faith shall not be entitled to any protection under this policy.

4.4 Any employee making allegations or reports that prove to have been made without good faith will be subject to disciplinary action (which may include termination of employment).

5. PROTECTION

5.1 Protection of Confidential Information

a. any person having the knowledge of the report of the misconduct or possessed the confidential information for the investigation of the misconduct shall make his or her best efforts to maintain the confidentiality of the information, especially the identity of the whistleblower.

b. the RI shall make his or her best effort to maintain the confidentiality of the reported incident, particularly the identity of the person who have allegedly committed to the misconduct, the nature of the misconduct and the fact of the report is filed, in order not to jeopardise any investigation.

c. the Group shall provide the assurance that no disciplinary action can be taken against the RI as long as he/she is doing it in a good faith.

d. the Group shall provide the assurance that the RI would be protected against reprisals and/or retaliation from his/her colleagues, immediate superior or head of department/division.

e. any head of department/division or employee who takes any detrimental action against the RI who has made a report of misconduct in good faith shall be subject to disciplinary action (which may include termination of employment).

5.2 Revoked of the protection

The protection against the RI will be revoked under the following circumstances :

a. Participated in the improper conduct;

b. Wilfully disclosed a false statement.

c. Makes a disclosure with malicious intent.

d. Makes a malicious or vexatious disclosure.

e. The Employee breaches his/her obligations of confidentiality under this Policy.

f. The report of Improper Conduct is made solely or substantially with the motive of avoiding dismissal or other disciplinary action.

5.3 The protection however does not provide the Group with the power to provide any immunity from criminal prosecution and also does not have any power to grant any protection from detrimental action to a whistleblower who is not an employee of the Group.

6. PROCEDURES – LOGGING A REPORT

6.1

a. The RI is advised to report any concern / suspect improper conduct, wrong doings, corruptions, fraud, waste or abuse as soon as he / she discovered the commission or intended commission of such act.

b. The RI may raise the improper conduct to his/her Head of Department, COO and/or CEO via email.

c. If these channels have been followed and the employee still has concerns or feels that the matter is so serious that it cannot be discussed with any one of the above, then he/she must raise it to the Chairman of the Audit Committee, Datuk Jory Leong by e-mail to joryleong@owg.com.my.

d. The RI shall make a confidential report of improper conduct in writing and to provide full details of the improper conduct and, where possible, supporting evidence.

e. Any disclosure made should contain the following :

i. The details of the person involved;

ii. Details of the allegations, including the nature of the allegation, where and when such misconduct took place;

iii. Supporting evidence (if applicable);

iv. RI’s name, Identity Card number, contact number, email.

7. HANDLING OF REPORTED VIOLATIONS

7.1 Preliminary Investigation

a. where the RI reported the said violation to the Head of Department or Management, the said violation should be forwarded to the Senior Management.

b. the senior officers at the Group will conduct a preliminary investigation of every report of improper conduct received to determine whether there are merits to initiate a full investigation and the findings of the preliminary investigation and recommendation shall be referred to the Chairman of the Audit Committee for a decision on whether to close the case or to proceed to a full investigation of the allegations

c. if the Chairman of the Audit Committee receive the violation report, he/she will conduct a preliminary assessment to establish whether the disclosure has merit and can be substantiated

d. if the case where the allegation has serious and significant adverse impact on the Group, the Chairman of the Audit Committee may decide to consult with the members of the Audit Committee or convene an Audit Committee meeting before making a decision.

e. the disclosure warrants an investigation, disclosure will be conducted as speedily and sensitively as possible. As far as reasonably practicable, the confidentiality of the RI will be maintained.

f. most investigation will be managed internally but the Group may appoint external investigators or investigating team, if deem appropriate

g. if the claim of malpractice is established, appropriate disciplinary action will be taken against the defaulting party/ies.

h. where it is believed that criminal activity has taken place, the matter may be reported to the police and appropriate legal action taken

i. however, if it is later discovered from an investigation that the disclosure/report was made with malicious intent, appropriate action can be taken against the RI.

j. the RI may withdraw the disclosure/report giving reasons, but the Group reserves the right to proceed with the investigations. The RI will be notified of the outcome of his/her disclosure.

7.2 Corrective Action

a. The Management shall carry out the decisions of the Board of Directors in relation to the findings of the investigation.

b. The Management shall institute the appropriate controls to prevent any further wrongdoings or damage to the Company.

8 PERIODIC REVIEW OF THE WHISTLEBLOWER POLICY AND REPORTING REQUIREMENTS

The AC shall review this Policy once in two (2) years or upon changes to the relevant rules and regulations, whichever is earlier and make the appropriate recommendation to the Board on any proposed amendments to the Policy. Periodic review would also be made to ensure the relevance and alignment with the Group’s needs and structure as well as material changes in the business and risk profile of key responsible person

FIT AND PROPER POLICY

1. PURPOSE

The purpose of the Fit and Proper Policy (“Policy”) is to set out the approach to the assessment of the fitness and propriety for the selection of candidates that are proposed to be appointed or elected / re-elected as the directors as well as the senior management (collectively referred as “Key Responsible Person”), for Only World Group Holdings Berhad and its Subsidiary Companies (collectively referred as “Group”). Key Responsible Person are the key persons who are accountable or responsible for the management and oversight of the Group. These comprise: a. Directors of the Group; b. Chief Executive Officers (CEO) or Managing Director (MD) of the Group including CEO or MD of subsidiary companies; c. Chief Financial Officer (CFO) or Financial Controller, Finance Director of the Group, Finance Director, Financial Controller or Chief Accountant of subsidiary companies. d. Any person performing a senior management function who has primary or significant responsibility for the management and performance of significant business activities of the Group; and e. Any person who has primary or significant responsibility for key control functions.

2. COMPLIANCE REQUIREMENTS

2.1 This Policy has been prepared to ensure compliance with the relevant provisions of the Main Market Listing Requirements (“MMLR”) of Bursa Malaysia Securities Berhad ("Bursa Malaysia”) and the Malaysian Code on Corporate Governance 2021 (“MCCG”). Reference is also made to the guidance provided in Bursa Securities’ Corporate Governance Guide. 2.2 The appointment of board and senior management are based on objective criteria, merit and with due regard for diversity in skills, experience, age, cultural background and gender. 2.3 Directors appointed should be able to devote the required time to serve the board effectively. The board should consider the existing board positions held by a director, including on boards of non-listed companies. Any appointment that may cast doubt on the integrity and governance of the Company should be avoided.

3. RESPONSIBILITY

The Board of Directors (“Board”) and Nomination Committee (“NC”) are primarily responsible for ensuring that all Key Responsible Persons fulfil fit and proper requirements and for conducting assessments of the fitness and propriety of Directors and the Group CEO as well as CEO/MD of subsidiary companies.

The NC is responsible to assess the existing directors or candidates as per Fit and Proper Policy and make the relevant recommendation to the Board on the proposal regarding appointment and re-election of Key Responsible Person, and making recommendations to the Board on these matters.

For other Key Responsible Persons, decisions on appointments and assessments of fit and proper may be made by the Group CEO or a designated committee under the delegated authority of the Board and NC.

4. FIT AND PROPER CRITERIA

Any person to be appointed or re-elected as a Key Responsible Person of the Group or a nominee director or representative on the boards of joint venture companies and associate companies must not be disqualified and has been assessed to have met all the fit and proper criteria based on, at minimum, the following: a. character and integrity; b. experience and competence; and c. time and commitment. 4.1 Character and integrity; a. Probity

is compliant with legal obligations, regulatory requirements and professional standards.

has not been obstructive, misleading or untruthful in dealings with regulatory bodies or a court.

b. Personal integrity

has not perpetrated or participated in any business practices which are deceitful, oppressive improper (whether unlawful or not), or which otherwise reflect discredit on his professional conduct.

service contract (i.e. in the capacity of management or director) had not been terminated in the past due to concerns on personal integrity.

has not abused other positions (i.e. political appointment) to facilitate government relations for the company in a manner that contravenes the principles of good governance.

c. Reputation

is of good repute in the financial and business community.

has not been the subject of civil or criminal proceedings or enforcement action, in managing or governing an entity.

has not been substantially involved in the management of a business or company which has failed, where that failure has been occasioned in part by deficiencies in that management.

d. Financial integrity

manages personal debts or financial affairs satisfactorily. demonstrates ability to fulfil personal financial obligations as and when they fall due.

4.2 Experience and Competence a. Qualifications, training and skills.

possesses education qualification that is relevant to the skill set that the director is earmarked to bring to bear onto the boardroom (i.e. a match to the board skill set matrix).

has a considerable understanding on the workings of a corporation

possesses general management skills as well as understanding of corporate governance and sustainability issues.

keeps knowledge current based on continuous professional development possesses leadership capabilities and a high level of emotional intelligence.

b. Relevant experience and expertise

possesses relevant experience and expertise with due consideration given to past length of service, nature and size of business, responsibilities held, number of subordinates as well as reporting lines and delegated authorities.

c. Relevant past performance or track record

had a career of occupying a high level position in a comparable organisation, and was accountable for driving or leading the organisation’s governance, business performance or operations.

possesses commendable past performance record as gathered from the results of the board effectiveness evaluation.

4.3 Time and Commitment a. Ability to discharge role having regard to other commitments

able to devote time as a board member, having factored other outside obligations including concurrent board positions held by the director across listed issuers and non-listed entities (including not-for-profit organisations). b. Participation and contribution in the board or track record demonstrates willingness to participate actively in board activities. demonstrates willingness to devote time and effort to understand the businesses and exemplifies readiness to participate in events outside the boardroom. manifests passion in the vocation of a director. exhibits ability to articulate views independently, objectively and constructively. exhibits open mindedness to the views of others and ability to make considered judgment after hearing the views of others.

5. ASSESSMENT OF FITNESS AND PROPRIETY

5.1 The fit and proper assessments on each Key Responsible Person must be made before the appointment or re-election. 5.2 All Key Responsible Person are required to declare that he or she remains a fit and proper person on an annual basis. 5.3 Where an existing Key Responsible Person no longer satisfies the fit and proper requirements, the Company or the Group must take all steps to remove that person from the responsible person position.

6. PERIODIC REVIEW OF THE FIT AND PROPER POLICY AND REPORTING REQUIREMENTS

The NC shall review this Policy once in two (2) years or upon changes to the relevant rules and regulations, whichever is earlier and make the appropriate recommendation to the Board on any proposed amendments to the Policy. Periodic review would also be made to ensure the relevance and alignment with the Group’s needs and structure as well as material changes in the business and risk profile of Key Responsible Person. This Policy was adopted on 1 June 2022.

ANTI-BRIBERY AND ANTI-CORRUPTION POLICY

- 1. POLICY AND OBJECTIVE

1.1 Only World Group Holdings Berhad (“OWGH”) and its subsidiaries (“the Group”) are committed to conducting its businesses with the highest standards of professional integrity and ethical behaviour and the same is required of every officer, employee and business partners.

1.2 The Group are committed to conducting its businesses to the best of our knowledge and belief in accordance with all the all-applicable laws and regulations in the areas that it operates. These laws include but not limited to Anti-Money Laundering and Anti-Terrorism Financing Act 2001, Malaysian Anti-Corruption Act 2009 (Amendment 2018), Personal Data Protection Act 2010 and Competition Act 2010. These laws prohibit acts of bribery and corruption, and mandate that companies establish and maintain adequate procedures to prevent bribery and corruption.

1.3 This Policy aims to ensure that all officers, employees, and business partners of the Group are aware of their obligation to disclose any corruptions, briberies, conflicts of interest or similar unethical acts that they may have, and to comply with this Policy to follow highest standards of ethical conduct of business.

1.4 This Policy will be updated as the Law and Regulations changes to incorporate the latest standards in accordance to all applicable laws and regulations.

2. SCOPE OF POLICY

2.1 The Anti-Bribery and Corruption Policy is a means where it is designed to offer a frame of reference and guidance to all persons working for and with the Group in ensuring that all applicable laws are observed and complied at all times.

2.2 This Policy applies to :

a. The Board of Directors

b. All Employees of the Group.

c. Any persons providing and or receiving services to the Group, namely, business partners, operators, agents, contractors, and consultants.

3. ANTI-BRIBERY AND ANTI-CORRUPTION

3.1 The Malaysian Anti-Corruption Commission in its website (www.sprm.gov.my) describes corruption as the act of giving or receiving of any gratification or reward in the form of cash or in-kind of high value for performing a task in relation to his/her job description.

It has clearly specified that the act of Soliciting, Giving, Accepting or Receiving, directly or indirectly to/from a person in authority in the form of money, services or valuable goods as an inducement or reward to or not to do an act in relation to the person’s principal affairs: as undertaking the act of corruption.

3.2 Under the Malaysian Anti-Corruption Commission Act 2009 (Amendment 2018), “Gratification” means of the below:

a. money, donation, gift, loan, fee, reward, valuable security, property or interest in property being property of any description whether movable or immovable, financial benefit, or any other similar advantage;

b. any office, dignity, employment, contract of employment or services, and agreement to give employment or render services in any capacity;

c. any payment, release, discharge or liquidation of any loan, obligation or other liability, whether in whole or in part;

d. any valuable consideration of any kind, any discount, commission, rebate, bonus, deduction or percentage;

e. any forbearance to demand any money or money’s worth or valuable thing;

f. any other service or favour of any description, including protection from any penalty or disability incurred or apprehended or from any action or proceedings of a disciplinary, civil or criminal nature, whether or not already instituted, and including the exercise or the forbearance from the exercise of any right or any official power or duty; and

g. any offer, undertaking or promise, whether conditional or unconditional, of any gratification within the meaning of any of the preceding paragraphs (a) to (f);

3.8 This Policy prohibits all forms of bribery and corrupt practices, and makes no distinction between whether they are being made to persons in the public or private sectors.

The directors, officer, employees and business partners of the Group must not directly or indirectly pay, offer or promise any gratification to any public official, party or their family members as an inducement for or reward for acting improperly. Furthermore, the officer, employees and business partner must not directly or indirectly pay, offer or promise any gratification to customers, Business Partners or any other party for the purpose of exerting influence, soliciting payment or other unfair or illegal preferential treatment. The directors, officer, employees and business partners of the Group will not suffer demotion, penalty or other adverse consequences in retaliation for refusing to pay or receive bribes or participate in other illicit behaviour.

4. GIFTS, HOSPITALITY AND ENTERTAINMENT

4.1 The directors, officer, employees and business partners of the Group shall not solicit or accept lavish gifts or gratuities or any offer, payment, promise to pay, or authorization to pay any money, or anything of value that could be interpreted to adversely affect business decisions or likely to compromise their personal or professional integrity.

4.2 No bribes, kickbacks or other corrupt payments in any form should be made to or for anyone for the purpose of obtaining or returning business or obtaining any other favours.

4.3 Occasional business gifts or festive gifts of modest value or entertainment maybe allowed but no gift or entertainment may be offered or given if it is deemed to be illegal or deemed to be inappropriate. Any forms of gifts of modest value or entertainment that is more than the value of RM100.00 and any amount of tipping received must be declared transparently to respective Head of Department or management.

4.4 All parties are required to submit a declaration form if any forms of gifts , tipping or entertainment are given at the immediate receival of such gifts, tipping or entertainments.

4.5 OWGH and all of its subsidiaries do not practice tipping and thus any directors, officer, employees and business partners of the Group shall not receive any forms of tips given by any parties.

5. FACILITATION PAYMENTS

5.1 Facilitation payments are a form small bribe payment made personally to an individual in control of a process or decision to secure or expedite the performance of a routine or administrative duty or function. In Malaysia, facilitation payment is seen as a form of corruption.

5.2 In any case, all persons whom are working for and with the Group must never pay, offer, solicit or receive any forms of facilitation payments under any circumstances. For any instances of facilitation payments or any form of bribes, the officer, employees and business partners of the Group are expected to immediately notify the higher authority within the Group as guided in the procedures set in the Whistle-blower Policy of the Group. All documents related must be shown immediately and to be kept properly.

6. POLITICAL CONTRIBUTIONS

6.1 In general, the Company does not make any political contribution of any sorts to support any political candidate, incumbent or party. The funds or resources of the Company must not be used under any circumstances be used to make any direct or indirect political contributions on behalf of the Company without any prior approval from the Board of Directors.

7. DONATIONS & SPONSORSHIPS

Donations in the form of charity is permissible as a form of commitment by the Company to corporate social responsibility. However, any forms of donations and sponsorships must be carefully examined for legitimacy and not to be made to improperly influence a business outcome of the Group.

7. DONATIONS & SPONSORSHIPS (Continued)

Any forms of sponsorships and donations by the Group are expected to comply with a set of guidelines prior to any form of contributions are distributed, such as:

a. All form of contributions within the jurisdiction of the applicable laws;

b. Authorization has been received by internal and external parties.

c. All contributions are to be given to legitimate entities with proper administration of the funds.

d. Ensured that the contributions are not done as a means to directly influence or obtaining a significant advantage to the Group in its business processes.

e. Not done as a means to cover up any form of bribery or corruption.

f. Not done as a way to tarnish company reputation.

8. THIRD PARTIES

8.1 The Group ensures that proper due diligence processes are done in an effort to ensure that all third parties or business partners agree to adhere to the Group’s standard operating procedures/policies/guidelines before engaging formal agreements with the Group.

9 CONFLICT OF INTERESTS

9.1 All officer, employees and business partners of the Group should endeavour to avoid situation that present a potential or actual conflict between their interest and the interest of the Group.

9.2 Directors, officers and employees are required to disclose to the Board any situation that may be, or appear to be, a conflict of interest (“Conflicted Director, officers and employees”). Directors, officers and employees are, therefore, obliged to act in the best interest of the Group.

9 CONFLICT OF INTERESTS (Continued)

9.3 A “conflict of interest” may occur when:

a. When a person’s private interest interferes in any way, with the interest of the Group; and/or

b. When a director, officer, employee or his/her family member takes an action or has an interest that may make it difficult for that director, officer and employee to perform his/her work objectively and effectively;

c. Director, officer and employee (or his or her family member) receives improper personal gains as a result of their position in the Group.

9.4 Directors, officers and employees are not to use information gained in the course of their duties for personal gains, to seek to use the opportunities they acquire in the course of their tenure as directors, officers and employees of the Company and/or its subsidiaries to promote their private interests or those of connected persons, firms, business or other entities.

9.5 Directors, officers and employees are not to use information gained in the course of their duties for personal gains, to seek to use the opportunities they acquire in the course of their tenure as Directors and Employees of the Company and/or its subsidiaries to promote their private interests or those of connected persons, firms, business or other entities.

9.6 In the event of a conflict of interest, potential or otherwise exists, the Conflicted Director, Officers and Employees should be absent from the meeting which the Board discusses the matter unless the Conflicted Director, officers and employees have been invited to be present in that meeting to clarify or assist in the discussion of the matter and not to vote on matter.

9.7 Directors, officers and employees shall declare any personal, professional or business interests that may be in conflict with their responsibilities.

10. WHISTLEBLOWING

The Group encourages all its employees, business partners and customers to report any real and/or suspected bribery or corruption that has occurred.

It is the policy of the Group to provide assurance that anyone who makes a report, complaint or disclosure would be protected against reprisals and/or retaliation from his/her colleagues, immediate superior, head of department/division or external parties. However this is subject that the report, complaint or disclosure is made in good faith, belief and without any malicious intent. (Details refer to the Group’s Whistleblower Policy).

The Group has established a proper whistleblowing channel where any reports, complaints and disclosure can be made to whistleblower@owg.com.my or to the Chairman of the Audit Committee, Datuk Jory Leong by e-mail to joryleong@owg.com.my which is covered under the Group’s Whistleblower Policy.

11. VIOLATION AND NON-COMPLIANCE OF POLICY

11.1 Any violation or non-compliance pertaining to this Policy or any other standard operation procedures/policies/guidelines related to this Policy are viewed seriously by the Group and is subject to serious disciplinary action (including the termination of employment) and criminal prosecution.

11.2 For Business Partners, non-compliance of this Policy may lead to termination of contract, criminal prosecution and claim for damages.

12. MONITORING, REVIEW AND REVISION OF POLICY

12.1 The Group is committed in ensuring that this Policy is a continuous effort in order to maintain the reputation and standards of the Group. Thus, the Group shall ensure that a review of this Policy is done every 2 years to assess its effectiveness and ensure that it continues to remain relevant and appropriate, such reviews may take the form of an internal audit, or an audit carried out by an external party.

12.MONITORING, REVIEW AND REVISION OF POLICY (Continued)

12.2 The Group reserves total rights to all amendments, deletions or changes to any terms and conditions or any part of this Policy, when necessary, including the use of an additional form, should there be a need to develop one.

12.3 The AC shall review this Policy once in two (2) years or upon changes to the relevant rules and regulations, whichever is earlier and make the appropriate recommendation to the Board on any proposed amendments to the Policy. Periodic review would also be made to ensure the relevance and alignment with the Group’s needs and structure as well as material changes in the business and risk profile of key responsible person.

13.EMPLOYEES COMMITMENT

13.1 This Policy is a public document which is shall be communicated to all directors, officers, employees and business partners of the Group and published in OWGH’s Corporate Website at www.owg.com.my, as such all directors, officers, employees and business partners are deemed to have read, understood and will abide by this Policy.

13.2 The Group shall ensure that adequate training on anti-bribery and anti-corruption shall be provided to the directors, officers, employees and business partners from time to time.

13.3 The directors, officers, employees and business partner are responsible for understanding and complying with the policy/policies. In particular, the employees should be familiar with applicable requirements and directives of the Policy and communicate them with the subordinates.

13.4 The employees are required to sign the policy acknowledgement form and a copy of the acknowledgement form shall be kept by the Human Resource Department for the duration of employment.

14. CORRUPTION RISK ASSESSMENT

14.1 The Group shall ensure that a comprehensive risk assessment of the Group’s exposure in relations to bribery and corruption risk shall be carried out at least once every 3 years with intermittent assessments conducted when necessary.

14.2 The risks assessments shall include all forms of financial and non-financial such as separation of duties and approving powers or multiple signatories for transactions.

15. RECORD SAFEKEEPING

15.1 All records should be in proper filing to be maintained with accuracy and completeness for all payments made to third parties in the ordinary course of business which is proven as evidence that such payments not linked to corrupt and/or unethical manner.

15.2 Employees must declare all gifts, hospitality or entertainment to respective Head of Department for recording purposes. All expenses claim from employees incurred to third parties should be approved by Head of Department and specifically recorded the reason for such expenses.

RISK MANAGEMENT FRAMEWORK

1. POLICY AND OBJECTIVE Only World Group Holdings Berhad (“the Company”)’s risk management process is designed to achieve the following policy and objectives: - 1.1 Risk Management Policy The Company shall establish and implement an effective Risk Management Framework to understand the Company’s profile and manage risks to and acceptable level. The Company shall endeavour to identify all risk associated with its business operations and also analyse in sufficient detail, report the risk timely and adopt appropriate measures to manage these risks effectively to acceptable levels. Each Division/ Business Unit of the Company shall understand and implement this policy and procedures of Risk Management. 1.2 Key Objective for risk management (a) Supports the fulfilment of the Group’s strategic objectives. (b) Optimise business opportunities and the returns to the Group, protect the stakeholder’s interests including shareholders, customers and staff within acceptable level of risks. (c) Promote and embrace education and Risk Assurance Culture. (d) Improve customer service whilst at the same time minimise risk exposure. (e) Safeguard the Group’s Assets and maintain its reputation and brand values. (f) Identify and assess operational risks and other related business risks in order to improve the Group’s operating performance without compromising effectiveness of internal control procedures. (g) Compliance to the Group policies, regulations and statutory requirements including timely reporting of performance. 1.3 Risk Management Guiding Principles The Company has the following specific risk management guiding principles to achieve the aforementioned policy and objectives: -

1.3.1 Operations (a) Implement effective internal control procedures which to be reviewed periodically by the senior management team for continuous improvements. (b) Compliance with the approving limit, policies and procedures of the Group. (c) Compliance with all regulations, legislation and by-laws. (d) Critical major assets of the Group must be adequately insured and maintained. (e) Develop and foster a strong safety and health culture. (f) The Group must have a cost-effective business recovery program covering primarily data loss and service availability. (g) Procedures to ensure effective customer service, complaint management, and accuracy and timeliness of billing. 1.3.2 Information and technology The Group must have an effective and efficient network security systems which must be continuously monitored to safeguard Group’s data and records. 1.3.3 Financial and Accounting (a) Ensure compliance to the relevant accounting standards and policy. (b) Adopt prudent and sound accounting and financial policies. (c) Ensure full and no omission of records and timely recording of financial records 1.3.4 Human Resources Development (a) Have in place a succession programme for all key management personnel. (b) All employees should be adequately trained, qualified and competent in their respective fields. (c) Motivate, reward and retain high performance staffs. 1.3.5 Business Development Business planning tools and processes in place to forecast and implement demand requirements. 2. EXTENT AND CATEGORY OF RISK In determining whether a risk is acceptable to the Group, the Board of Directors, the Managing Directors and Group Chief Executive Officer are required to ascertain the levels of risk appetite of the company. Risk appetite refers to the risk tolerance vis-à-vis the returns, or simply the extent of risk that a company can take or tolerate in relation to the potential gains or advantage for a specified condition. In computing the risk appetite, the industry’s risk appetite, the expected return on investment, return on capital employed, the pay-back period for projects or any other means can be taken into consideration. The aggregated risk capacity of the Division/ Business Units will determine by the Group’s risk capacity. Hence, the risk capacity of each Division/ Business Unit is in line with the overall Group’s risk capacity. 2.1 Extent and category of risk (on a single occurrence) The extent and category of risk, where practical and possible, should be determined by taking into consideration various factors such as the nature of the Group’s and the Company’s principal activities, the industry norm and risk appetite. However, the magnitude of the extent of risk in safety and human resources risks are not quantifiable.

3. THE GROUP CHIEF EXECUTIVE OFFICER AND GROUP CHIEF OPERATING OFFICER The Group Chief Executive Officer (“GCEO”) and Group Chief Operating Officer (“GCOO”) review the entire risk management framework, processes and procedures that are developed. GCEO and GCOO provide regular feedback and advice to the Audit Committee and Board of Directors. The management is responsible for the implementation of Board policies on risk and control. In fulfilling its responsibilities the GCEO, GCOO and the management should, within the business and operating processes of all functions, identify and evaluate the risk faced by the Group for consideration by the Board and design, operate and monitor a suitable system of internal controls which implements the policies adopted by the Board. 4. FRAMEWORK OF THE RISK MANAGEMENT PROCESS A structured framework approach to risk management that incorporates all the steps that need to be considered is therefore developed. These steps are below and depicted in Figure A. Appropriate tools and techniques should be continuously implemented in order to effectively manage the risk. 4.1 Risk Identification Risk identification is continuous and depends on effective communication within the Group and the Company. Differences in operations and conditions give rise to differing risks. Some risks are obvious whereas many can be overlooked. A variety of risk identification tools including questionnaires, checklists and procedures guides are designed to assist in risk identification. In order to identify the significant risks facing by the Group and the Company, a systematic approach to risk identification is set out below. 4.1.1 Identify the internal and external environments The Group’s business processes incorporate risk identification. For example: (a) The business planning process incorporates the risk policy and objectives. (b) The purchasing process incorporates the identification of cost overrun, quality of product and ability to deliver on time. The risk identification starts with gain knowledge of the inter-relationships from the Group’s business processes, tasks, activities and culture of the Group.

The risk identification techniques include: (a) Review of the Business Plan (yearly business plan, strategies and divisions). (b) Analysis of the mission and objective of the Company and the Group. (c) Analysis of the strategies to achieve the objectives. (d) Strengths, weaknesses, opportunities and threats (“SWOT”) analysis (e) Analysis of financial statement. i. Analysis of the core business process when there is a new or change in the existing business process. ii. Review of the Group chart and the reporting structure when there is a reorganization/ restructuring or change in senior management. iii. Review of existing corporate policies. Another source of risk is a change in the external environment. Changes in these circumstances are uncontrollable by the Group but all have the potential to produce a loss to the Group. 4.1.2 Recognise risk areas Please refer to Appendix A for the Group and the Company risks. 4.1.3 Types of risks (a) Inherent risk Inherent risk is risk that relate to the nature of business and which are generally outside the control of the Management. (b) Control risk Control risk is risk that a material errors occur and cannot be prevented or detected by the internal control system on a timely basis

4.2 Risk Assessment and Measurement 4.2.1 Risk assessment Each risk identified is measure for: (a) Likelihood The expected frequency of the risk occurs in current internal control system.  (b) Impact The expected level of impact of the risk in current internal control system.

(b) Impact The expected level of impact of the risk in current internal control system.

(c) Risk assessment matrix The table to allocate risk ratings for two intersecting factors, likelihood and impact.  4.3 Risk evaluation Risk evaluation is evaluating the level of risk found in risk assessment matrix. The higher the risk, the more of a priority controlling that risk should be.

4.3 Risk evaluation Risk evaluation is evaluating the level of risk found in risk assessment matrix. The higher the risk, the more of a priority controlling that risk should be.

4.4 Risk Management The Risk Management is a decision-making process how each risk is to be managed. The available resources and size of the potential loss have to consider before decision made. Risk management include: (a) Accept Allow minor risk to exist to avoid spending more on managing the risks than the potential harm. The risks accepted are those that will lead to relatively small certain losses. (b) Avoid Avoidance takes place when decisions are made to prevent a risk from even coming into existence. Avoidance used when the risk cannot be reduced or transferred. It will result the Group and the Company not being able to achieve their primary objectives. (c) Transfer Risk may be transferred or distributed to another party who is more willing to bear the risk. Some techniques or risk transfer are the process of hedging, insurance, subcontracting of certain activities or some other contractual arrangements. Risk sharing is also a special case of risk transfer and an example of risk sharing is pooling of interest. (d) Mitigation The risk is reduced by reducing the consequence of risk or reducing the likelihood of the risk occurring.

4.5 Risk Monitoring (a) Review The contribution of risk management to the business performance should be reviewed regularly to keep track of the risks identified and the effectiveness of the risk responses which are implemented by the Company and the Group. Monitoring can help to ascertain whether proper policies were followed, whether new risks can now be identified or whether previous assumptions to do with these risks are still valid. (b) An evolving process Operational risk management is not a static process. Having identified the risk in the business activities, the Group need to monitor these risks on an ongoing basis and in a consistent manner. Further the control framework should be enhanced over time. (c) Environmental Consideration has to be given whether there are any trends or current factors relevant to the Group’s activities, markets or any external environment that have changed or are expected to change the risk faced by the Group. (d) Reduce consequence In area where risk management is found to be weak, immediate action plans to address the weaknesses should be taken

5. COMMUNICATION The whole process of risk management must be communicated to all employees within the Group. The Management responsible for strategic and operational decisions must be aware and apply the risk management process continuously. An efficient feedback mechanism should also be in place. Training in risk management should be given to all relevant employees to enhance greater understanding and facilitate informed decision making.

BOARD CHARTER

1. INTRODUCTION

The Board of Directors (“Board”) of Only World Group Holdings Berhad (“OWG” or “Company”) recognizes that good corporate governance practices and culture are the keys to OWG’s success, sustainability and survival in the ever changing social, economic and political eco-systems in the business environment locally and globally. The Board is, therefore, wholly committed to applying the principles necessary to ensure good corporate governance is practiced throughout OWG in all its business dealings in respect of its shareholders and other stakeholders.

This Charter sets out the key corporate governance principles adopted by the Board of the Company.

2. PURPOSE

The Board Charter of ONLY WORLD GROUP HOLDINGS BERHAD sets out the composition, roles and responsibilities of the Board.

3. BOARD STRUCTURE

3.1 Composition and Board Balance

- The Board consists of qualified individuals with diverse set of skills, experiences and knowledge that are necessary and relevant to the Group’s business operations. The composition and size of the Board is such that it facilities the decision making of the Company.

- There is a clear segregation of responsibilities between the Chairman and the Chief Executive Officer to ensure a balance of power and authority.

- The number of directors shall be not less than two (2) nor more than nine (9) as set out in the Company’s Constitution.

- Profiles of Board members are included in the Annual Report of the Company.In accordance with the Main Market Listing Requirements of Bursa Malaysia Securities Berhad (“Listing Requirements”), the Company must ensure that at least two (2) Directors or 1/3 of the Board of the Company, whichever is the higher, are independent directors. If the number of directors of the Company is not three (3) or a multiple of three (3), then the number nearest 1/3 must be used. In the event of any vacancy in the Board, resulting in non-compliance, the Company must fill the vacancy within three (3) months.

- An Independent Director is one who is independent from management, free from any relationship or any transaction, which may interfere with their independent judgment or the ability to act in the best interest of the Company and are willing to express his/her opinion at the Board Meeting free of concern about their position or position of any third party.

- New Directors are expected to have such expertise so as to qualify them to make a positive contribution to the Board performance of its duties and to give sufficient time and attention to the affairs of the Company.

- The appointment of a new Director is a matter for consideration and decision by the full Board upon appropriate recommendation from the Nominating Committee.

- In the case of candidates for the position of Independent Non-Executive Directors, the Nominating Committee should also evaluate the candidates’ ability to discharge such responsibilities/functions as expected from Independent Non-Executive Directors.

- The Company Secretary has the responsibility of ensuring that relevant procedures relating to the appointments of new Directors are properly executed.

3.3 Re-election

- All newly appointed Directors shall retire and shall be eligible to be re-elected by the shareholders at the Company’s annual general meeting.

- Pursuant to the Company’s Constitution, an election of Directors takes place subsequent to their appointment each year where 1/3 of the Directors or if their number is not 3 or a multiple of 3, then the number nearest to 1/3, shall retire by rotation from office and shall be eligible for re-election at each annual general meeting and that each Director shall retire from office at least once in every 3 years and shall be eligible for re-election.

- The Directors to retire in each year shall be those who have been longest in office since their last election, but as between persons who became Directors on the same day those to retire (unless they otherwise agree among themselves) be determined by lot.

3.4 Tenure of Independent Director

- The Board (Nominating Committee) assesses the independence of the Directors annually.

- The tenure of the Independent Directors shall not exceed a cumulative term of twelve (12) years, subject to the assessment of the Nominating Committee and valid justifications.Upon completion of the twelve (12) years, the said independent Director if continue to serve on the Board, shall be redesignated to non-independent Director.

3.5 Independence Criteria

In determining/assessing the “independence” of its Directors, the Company also adopts the independence criteria of the Listing Requirements which states that an Independent Director:

- is not an executive Director of the Company or any related corporation (“Said Corporation”);

- has not been within 2 3 years and is not an officer (except as a director who has served as an independent director in any or more of the Said Corporation for a cumulative period of less than 12 years);

- is not a major shareholder of the Said Corporation;

- is not a family member of any executive director, officer or major shareholder of the Said Corporation;

- is not acting as a nominee or representative of any executive director or major shareholder of the Said Corporation;

- has not been engaged as an adviser or is not presently a partner, director (except as an independent director) or major shareholder, as the case may be, of a firm or corporation (“Entity”) which provides professional services to the Said Corporation within the last 3 years and the consideration for the professional advisory services to the Said Corporation in aggregate is not more than 5% of the gross revenue on a consolidated basis (where applicable) of the said Director or the Entity or RM1 million, whichever is higher – Practice Note 13 of the Listing Requirements);

- has not engaged in any transaction or is not presently a partner, director of major shareholder as the case may be, of a firm or corporation (other than subsidiaries of OWG) which has engaged in any transaction with the Said Corporation within the last 3 years and the consideration for the transaction in aggregate is not more than 5% of the gross revenue on a consolidated basis (where applicable) of the said Director or the Entity or RM1 million, whichever is higher – Practice Note 13 of the Listing Requirements); and

- has not served as an Independent Director in any one or more of the Said Corporation for a cumulative period of more than 12 years form the date of his first appointment as an Independent Director.

3.6 Performance Assessment

The Board reviews and evaluates its own performance and the performance of its Committees on an annual basis against both measurable and qualitative indicators.

4. COMPANY SECRETARY

- The Board appoints the Company Secretary, who plays an important advisory role, and ensure that the Company Secretary fulfils the functions for which he/she has been appointed.

- The Company Secretary provides guidance to the Board on matters pertaining to the Board’s responsibilities in order to ensure that they are effectively discharged within relevant legal and regulatory requirements.

- The appointment and removal of the Company Secretary is a matter for the Board as a whole. The Board recognizes the fact that the Company Secretary should be suitably qualified and capable of carrying out the duties required.

- The Company Secretary must keep abreast of, and inform, the Board of current governance practices.

5. BOARD COMMITTEES

- The Board has delegated certain functions to certain Committees with each operating within its clearly defined terms of reference. The Chairman of the various Committees will report to the Board on the outcome of the Committee meetings.

- The Board has established the following Committees to assist the Board in the execution of its duties:

(i) Audit Committee

(ii) Remuneration Committee

(iii) Nominating Committee

- The roles and responsibilities of Audit, Remuneration and Nominating Committees are set out in the terms and reference of each Committee.

- The Chairman of the relevant Board Committees will report to the Board on the key issues deliberated by the Board Committees at the Board meetings.

6. DIRECTORS’ REMUNERATION

- Directors’ remuneration is generally determined at levels which would continue to attract and retain Directors of such calibre to provide the necessary skills and experience as required and commensurate with the responsibilities for the effective management and operations of the Group.

- The level of remuneration of the Chief Executive Officer and Executive Directors are determined by the Remuneration Committee after giving due consideration to the compensation levels for comparable positions among other similar Malaysia public listed companies and are so as to link short and long-term rewards to corporate and individual performance.

- The level for Non-Executive Directors shall reflect the contribution and level of responsibilities undertaken by the particular Non-Executive Director.

- The fees of the individual Board members of the Company are disclosed in the Annual Report.

7. ROLES AND RESPONSIBILITIES OF THE BOARD

- The Directors are responsible for managing the business of the Company and may exercise all the powers of the Company which are required, by the provisions of the Companies Act 2016, Company’s Constitution and Listing Requirements as well as other applicable laws and regulations.

- In discharging his/her duties, each Director must:

(i) exercise care and diligence;

(ii) act in good faith in the best interests of the Company;

(iii) not improperly use his/her position or misuse information of the Company; and

(iv) commit the time necessary to discharge effectively his/her role as a Director

7.1 Role of Board

The functions of the Board are to:

- Establish the organization’s values, vision, mission and strategies.

- Provide guidance to Senior Management in developing corporate strategy.

- Reviewing and set the Group’s strategic plan and direction.

- Review and agree the business (action) plans and annual budget proposed by the Executive management team.

- Promote better investors relations and shareholder communications.

- Ensure that the Group’s core values, vision and mission and shareholders’ interest are met.

- Establish such committees, policies and procedures as appropriate, compliance obligation and functions are effectively discharged.

- Arrange for Directors to attend courses, seminars and participate in development programs as the Board judges appropriate.

- Ensure that all significant systems and procedures are in place for the organization to run effectively, efficiently, and meet all legal and contractual requirements.

- Ensure that all significant risks are adequately considered and accounted for by the Senior Management team / Head of Department.

- Ensure that organization has appropriate corporate governance in place including standards of ethical behaviour and promoting a culture of corporate responsibility.

- Approving specific items of capital expenditure and investments, acquisitions and dis-investments and any significant initiatives or opportunities that arise outside the annual planning and budgeting process.

- Approving and monitoring major projects including corporate restructuring/re-organization.

- Overseeing the conduct and performance of the Company and subsidiaries to ensure that they are being properly and appropriately managed.

- Appointing Directors to the Board.

- Approving the quarterly, full-year financial statements and annual report.

- Reviewing and deciding on payment of dividend.

- Reviewing and monitoring all related party transactions to identify whether consideration should be given to seeking shareholders’ approval.

7.2 Role of Chairman, Chief Executive Officer and Independent Non-Executive Director

- The roles of the Chairman, Chief Executive Officer and Independent Non-Executive Director are strictly separated.

- The Chairman is responsible for:

(i) leading the Board in setting the values and standard of the Company.

(ii) overseeing the effective discharge of the Board’s supervisory role.

(iii) Facilitating the effective contribution of all directors.

(iv) conducting the Board’s function and meetings.

(v) briefing all the directors in relation to issues arising at meetings.

(vi) ensuring effective communication with shareholders and relevant stakeholders.

(vii) scheduling regular and effective evaluations of the Board’s performance.

(viii) ensuring the provision of accurate, timely and clear information to Directors.

(ix) promoting constructive and respectful relations between Board members and between the Board and the Management.

- The Chief Executive Officer is responsible for: